- Alternative investments offer diversification, high return potential, unique opportunities, and passive income generation.

- They include precious metals, real estate, hedge funds, collectibles, art, and cryptocurrencies.

- Alternative investments are often uncorrelated with traditional stock and bond markets, protecting against their fluctuations.

- Unique assets, such as art and collectibles, offer unique investment opportunities unavailable in traditional markets.

- Collectibles, art, precious metals, and cryptocurrencies are the top alternative investments.

In today’s economy, investing can be a tricky game. With traditional investments like stocks and mutual funds subject to fluctuations in value, young investors have begun to explore other portfolio options. Alternative investments, or investments outside of traditional stock and bond markets, have become increasingly popular, with young investors looking for ways to balance their portfolios with unique and potentially profitable investment opportunities. Here’s what you need to know about alternative investments, reasons to invest in some today, and the best alternative investments to put your money on.

What Are Alternative Investments?

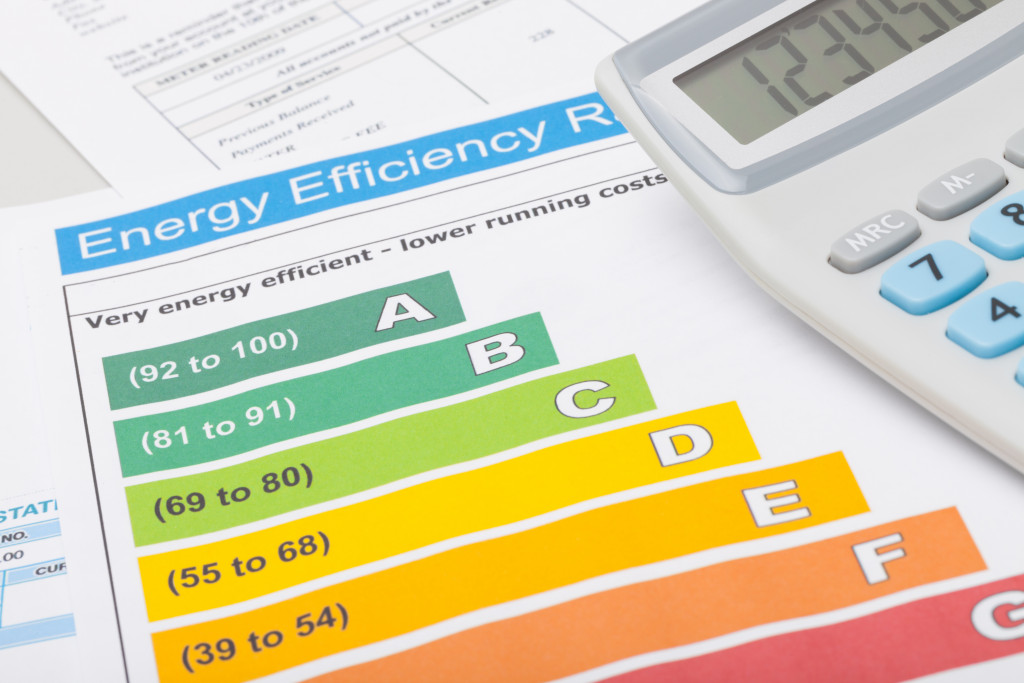

Alternative investments are investments outside of traditional stock and bond markets. They may include precious metals, real estate, and private equity funds. Hedge funds, which employ various strategies to earn returns from events that cause market shifts, are another popular alternative investment option. These investments are highly illiquid but can offer higher returns than the standard stock and bond markets in the long run. Here are the other benefits of investing in them:

1. Diversification

The first reason young investors should explore alternative investments is diversification. Alternative investments can provide a hedge against the risks associated with traditional investments. Most alternative investments are not correlated to the stock market and have a low correlation to bond markets.

This means that as stock and bond investments see fluctuations in value, alternative investments can protect against those fluctuations. By diversifying your portfolio with alternative investments, you can achieve an overall portfolio risk that suits your investment goals.

2. Potential for High Returns

Another reason to invest in alternative investments is the potential for high returns. While no investment comes without risk, alternative investments such as venture capital, private equity, and real estate can provide returns that exceed those of traditional investments. The key is finding the right investment to meet your goals and risk tolerance.

3. Unique Investment Opportunities

Perhaps the most significant advantage of alternative investments is the opportunity to invest in unique assets not available through traditional investments. These investments can include things like art, wine, and collectibles. For example, a young collector investing in rare coins has the potential to make a significant return if they successfully acquire rare and desirable coins. Similarly, an investor in fine art can profit from buying and selling valuable paintings at auctions.

4. Potential for Passive Income

Alternative investments, such as real estate or precious metals, can also provide passive income opportunities. For example, owning and renting commercial real estate can generate a monthly income stream. Precious metals investing can also generate passive income through dividends paid by mining companies. With some alternative investments, investors can receive regular payments and start building wealth over time.

Best Alternative Investments Today

Some of the best alternative investments don’t come in the form of real estate. Here are four of the best alternative investments today:

Collectibles

One of the best alternative investments is collectibles. Collectors’ items, such as bullion coins, can have a huge profit margin in the future. You can search for affordable bullion coins today and see that they can help you make a good return on investment when it comes. They are currently cheap, but in the future, when they become a rare commodity, their value will increase astronomically.

Art

One of the best alternative investments you can make today is art. Investing in art can also allow you to own something unique and valuable, which could potentially increase in value over time.

Precious Metals

Investing in precious metals like gold is also a great way to invest in alternative investments. Precious metals have traditionally been considered safe investments and can offer a hedge against inflation or stock market volatility. As with other forms of investing, you should research before investing in precious metals, as certain coins may be more valuable than others depending on their rarity and condition.

Cryptocurrencies

Cryptocurrencies have become increasingly popular and can be a great way to diversify your portfolio. Cryptocurrencies are digital currencies that are decentralized, meaning that they operate independently of traditional financial systems. Cryptocurrencies require more research than other alternative investments, as their value is volatile and prices change quickly. However, they can be profitable and exciting if done correctly.

Alternative investments can open opportunities for young investors looking to diversify their portfolios. Consider these four best alternative investments when building your portfolio and ensuring long-term financial success. With some research, you could find the perfect balance of risk and reward that suits your goals.